Government urged to back hydrogen for HGVs

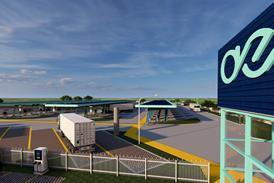

Hydrogen UK has called on the government to focus policy support for hydrogen on “high value cases”, including for HGVs, which it says need hydrogen for its “unique advantages for payload and refuelling time”.

You have reached your limit of free news

Register for free today to read more content. Already registered? SIGN IN now

Want to read more?

Register for free now to access the full article.

Let us help you reach your carbon zero targets, sign up today and unlock:

- Unlimited access to breaking news, commentary and analysis around the decarbonisation of the road freight and commercial vehicle sector

- Continued access to the Freight Carbon Zero weekly newsletter, sent directly to your inbox

![Mercedes-Benz_eActros_600_(1)[1]](https://d2cohhpa0jt4tw.cloudfront.net/Pictures/274x183/8/1/8/17818_mercedesbenz_eactros_600_11_556244.jpg)