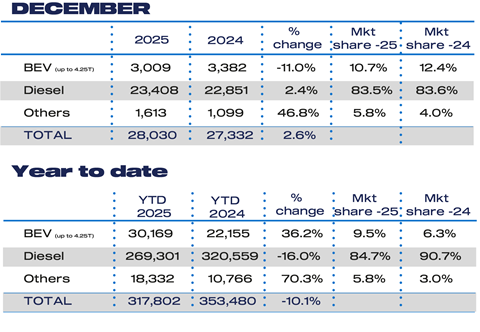

Whilst the UK’s new light commercial vehicle (LCV) market declined by 10.3% in 2025 with 315,422 vans, pickups and 4x4s registered, deliveries of new electric vans leapt by a record 36%, according to the latest figures published by the Society of Motor Manufacturers and Traders (SMMT).

The data, published today (6 January), shows that fleet renewal shrank in every month last year other than December, which posted a slight 1.7% rise, which SMMT said reflects a challenging economic environment and weak business confidence.

Across the year, registrations of new medium-sized vans declined 20.7% to 51,639 units, while large vans dropped 9.8% to 210,262 but remained the most popular segment with a 66.7% share of the overall market.

There was growth in the lower-volume segments, with registrations of small vans and 4x4s up 1.9% and 2.3% respectively, to 8,766 and 7,447 units.

In contrast, deliveries of new battery electric vans (BEVs) rose by an impressive 36.2% with 30,169 registrations – a new annual record.

The SMMT hailed the growth as a “significant achievement in a contracting overall market” which it said is driven by massive industry investment to provide more than 40 different zero emission van models – representing more than half of new model choice.

However the SMMT added that despite this offering, manufacturers still had to subsidise their sales of EVs to bridge the gap between mandated ambition and real-world demand, with almost £400m in discounts in 2025.

The full year EV market share stands at only 9.5%, however, well short of the 16% mandated for the year, reflecting a clear gap between ambition and reality.

SMMT said critical barriers to take up remain, including higher production costs, a paucity of van-suitable public charging and lengthy waiting times for depots to get connected to the grid.

The society added that the extension of the Plug-in Van Grant, the new Depot Charging Scheme and proposed planning reform for private charger installations will help, but warned that the steep rise in mandated ambition to 24% in 2026 will need further action.

It called for an urgent review of the transition to ensure the regulation and support measures deliver required demand without undermining industry’s viability, warning that with changes taking place in the EU, US and elsewhere, the UK market must remain healthy to safeguard its investment appeal.

Mike Hawes, SMMT chief executive, said, “2025’s new van market reflects a tough economic environment which constrained fleet investment.

“While rising EV uptake is encouraging, it has come at a huge cost to industry and remains significantly adrift of ambition.

“Government’s upcoming review must acknowledge the unique challenges facing the light commercial vehicle sector and the additional action required, else the gap between market regulation and reality will continue to widen.”

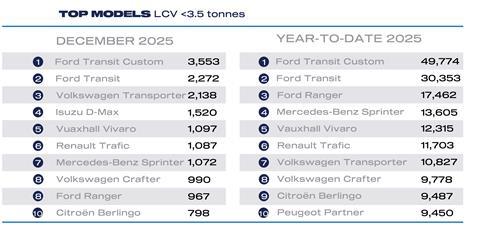

SMMT also revealed the top selling models for December and for the whole of 2025, which showed that the Ford Transit Custom continued to dominate the charts in 2025, coming in as the most popular model in December last year and across the whole of 2025.

In second place on both charts was the Ford Transit, whilst the Ford Ranger was the third most popular model in 2025, with the Volkswagen Transporter taking third place in the December 2025 line-up.

Supporting documents

Click link to download and view these filesDec-LCV-2025

Zip, FileSizeText 2.62 mb

![Mercedes-Benz_eActros_600_(1)[1]](https://d2cohhpa0jt4tw.cloudfront.net/Pictures/274x183/8/1/8/17818_mercedesbenz_eactros_600_11_556244.jpg)