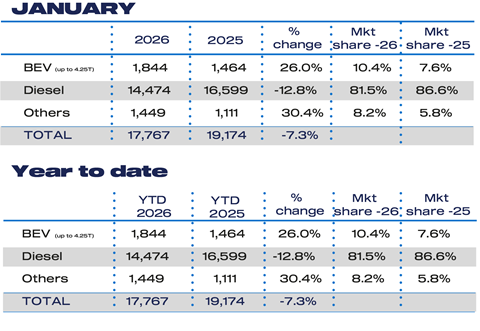

New light commercial vehicle (LCV) registrations fell by 7.8% in January, despite electric van sales rising by more than a quarter, as demand for diesel vans and pick ups fell, according to the latest research by the Society of Motor Manufacturers and Traders (SMMT).

The figures revealed the the weakest start to a year since 2012, which SMMT said reflects a tough economic environment, with weak business confidence constraining fleet investment.

The decline was driven by a 57.0% slump in demand for new pickups to 1,206 units, following government fiscal changes to treat double cabs as cars for benefit in kind and capital allowance purposes.

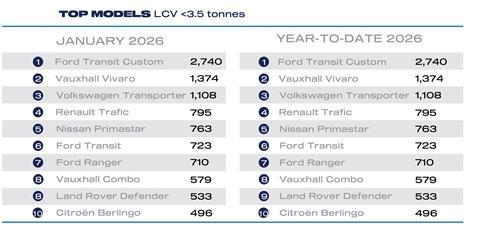

Demand for medium vans also fell, by 27.4% to 2,547 units, while the lower volume small van segment contracted by 39.8% to 402 units.

Only large vans and 4x4s posted growth, up 10.0% to 12,696 units and 33.9% to 711 respectively.

Headline growth in electric van registrations also remained positive, with uptake rising 26.0% to 1,844 units.

However SMMT warned that with electric vans market share standing at just 10.4%, demand would have to more than double to meet the mandated target of 24% in 2026, adding: “Delivering such growth in a weak overall market, and despite more than half of all models now available as EVs, with unprecedented discounts on their sale, poses an immense challenge.”

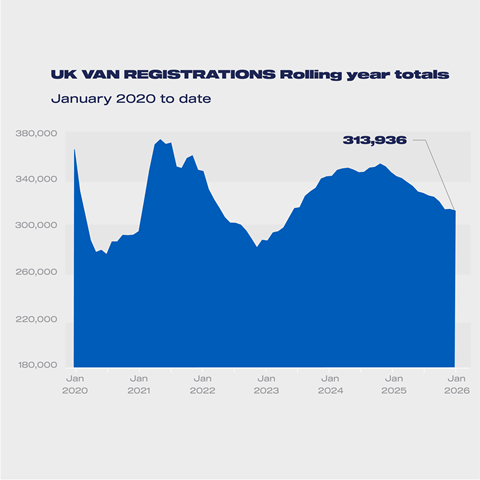

The latest industry outlook for 2026 has been revised downwards, with 321,000 units expected to be delivered this year - still a 1.9% increase on 2025, but a significant softening from the 335,000 anticipated in the previous October outlook.

Similarly, while the latest BEV outlook expects more than 50% growth this year, the market share has been revised down to 13.1%, from the 14.0% share expected in the last outlook.

SMMT said: “Industry continues to urge government to provide the conditions for sustainable growth. While last year’s extension of funding for the Plug-in Van Grant until 2027 was welcome, clarity is urgently needed on the timing, scale and conditions of support beyond April this year.

“The new Depot Charging Scheme and proposed planning reform for private charger installations will help the transition, but further action is necessary given critical barriers remain, including stubbornly high energy costs, a paucity of van-suitable public charging, and lengthy waiting times for depot-to-grid connections.”

Mike Hawes, SMMT chief executive, commented: “January’s decline in new van uptake reflects ongoing economic and fiscal conditions which are limiting demand, particularly for pickups, as industry had warned.

“Rising EV uptake is encouraging but delivering the UK’s world-leading ambition is coming at huge cost to industry amid overall market contraction.

“With an even steeper 2026 target that is further still from real-world demand, government’s review of the transition must come urgently, recognising additional action is needed to deliver on ambition.”

responding to SMMT’s figures, Jon Lawes, Managing Director at Novuna Vehicle Solutions managing director, said: “Today’s figures show that despite a wider choice of more competitively priced models and ongoing discounting, EV adoption is stalling, which is largely down to limitations in charging infrastructure.

Mass adoption will only come when public charging is as dependable as filling up, with reliable rapid chargers beyond the big cities and fair pricing that doesn’t penalise drivers who can’t charge at home.

“Discounts can pull demand forward in the short term, but long-term growth depends on decisive action to scale a truly nationwide, publicly accessible rapid-charging network with faster delivery, clearer accountability and a better customer experience wherever you live.”