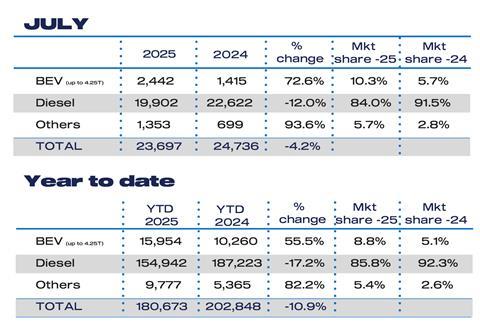

The new light commercial vehicle (LCV) market fell by 5.1% in July to 24,433 LCVs, the sector’s eighth consecutive month of decline, and the weakest July since 2022, whilst in contrast demand for electric LCVs rose by 72.6% to 2,442 in July – totalling eight months of continuous growth.

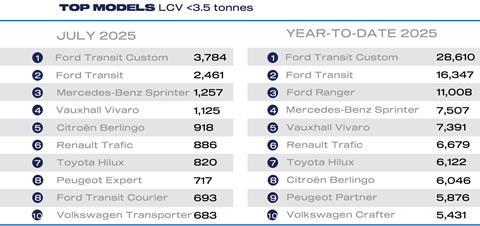

According to the latest research from the Society of Motor Manufacturers and Traders (SMMT), sluggish business confidence and tough economic conditions contributed to demand falling across most segments in the month, with uptake of the smallest vans recording the sharpest drop, down 20.6% to 738 units, while deliveries of the largest models fell 4.6% to 16,040 units. However, registrations of mid-sized vans, rose 2.5% to 4,138 units during the period.

On the upside, manufacturers’ investment in electric van models, payloads and price points appears to be paying off with with deliveries of BEVs rising by 72.6% to 2,442 in July – marking eight months of continuous growth.

However this is not enough to meet the ZEV Mandate. In the year to date, BEVs represent just 8.8% of the overall market – a significant distance from the 16% mandated.

SMMT said this highlights the need for urgent action to boost operator confidence It called for moves to expedite depot grid connections, ensuring efficient implementation of local planning and prompt delivery of LCV-suitable infrastructure, to encourage investment and accelerate the transition.

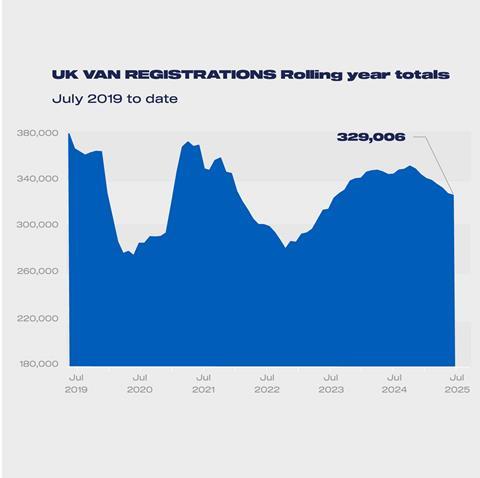

The latest 2025 outlook has been revised downwards, with the market now expected to decline by more than 30,000 units, a fall of 8.7%, to 321,000 units.

The BEV share of LCV registrations up to 3.5 tonnes has also been adjusted downwards for 2025, to 8.6%,4 with a marginal increase to 13.7% expected in 2026 against a mandated target of 24% in that year.

SMMT said: “The Plug-in Van Grant remains a lifeline for industry, so we await further details of the ongoing support announced in the Comprehensive Spending Review.

“Many businesses are still being held back, however, by a lack of access to suitable commercial vehicle charging at public, depot and shared hub locations.

“Market regulation is only workable if sufficient operators can switch so government must ensure greater access to LCV-suitable infrastructure across the country.

“Preferential treatment for depot grid connections is also a necessary step, given some sites could face waits of up to 15 years, and consistent and efficient implementation of local planning policy would give fleets the confidence they need to transition their operations to zero emissions.

Mike Hawes, SMMT chief executive, added: “Half a year of declining demand for new vans reflects a difficult economic climate and weak business confidence and the fact that this downturn comes just as industry invests heavily to expand its zero emission LCV offering is particularly concerning.

“Decarbonisation remains a shared ambition but with the EV market more than a third below this year’s target, bold measures are needed to drive demand.

“Accelerated CV infrastructure rollout, quicker grid connections and streamlined planning are now critical.”

![Mercedes-Benz_eActros_600_(1)[1]](https://d2cohhpa0jt4tw.cloudfront.net/Pictures/274x183/8/1/8/17818_mercedesbenz_eactros_600_11_556244.jpg)