A ‘pause’ has been enacted in projects joining the queue to connect to the high-voltage national electricity transmission network.

On 29 January GB’s transmission network operators stopped accepting applications for new generation to connect, and the window will remain closed until at least 31 May. Does that mean planned new low carbon generation - and so-called ‘demand’ customers who want to upgrade or expand their facilities that will draw more power - will face even longer delays?

First it is important to state that the ‘pause’ does not apply to demand customers, who can continue to make connections applications. Nor does it apply to most companies who have relatively small projects and want to connect via distribution network operators (DNOs) at low voltage (the pause does apply for specific small projects that might trigger effects at transmission level).

Even for companies who want to connect to the transmission network, the effect of the pause on those organisations is likely to be ‘lost in the noise’, as far larger changes to the network connections regime take effect – and as the network itself grows.

Transmission network operators had been pressing the regulator to allow them to stop accepting connection requests, because each requires the network to carry out an analysis to see whether the proposal would necessitate upgrades. Simply carrying out that work has overstretched connections departments – and these are the same engineers who will be required to deliver a reformed connections process.

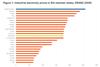

In January, national system operator NESO said: “Grid connections applications have continued to grow over the last year to the point that it is no longer possible to deliver in-flight connections reforms in parallel with the existing connections process. In 2023/24 alone, NESO received over 1,700 queue applications, with more projects already in the queue than is required for the energy system in 2030 or even 2050.”

In a decision letter accepting the need for the pause in applications, regulator Ofgem said “The transitional arrangements that were introduced from 2 September 2024 have proven to be insufficient in reducing the workload”.

With so many projects in the queue already, addressed on a ‘first come, first served’ basis that mean some would wait a decade or more, new projects could never move up the queue, even if they could join it.

The reform will mean that instead of requesting connection first, projects will not progress unless they pass tests such as whether they have secured the land and planning approval that would allow the project to proceed. These tests will mean some projects exit the queue. It is not clear how high this attrition rate will be, but it is likely to be significant. In responding to a consultation on the process the Association for Distributed Energy (ADE) said, “we think NESO should anticipate a higher rate of attrition than it currently does (given legal challenges to planning applications and general planning delays etc.)”.

Meanwhile the coming five years will see an expansion transmission lines. Strategies and requirements have been set by NESO, and energy regulator Ofgem will decide at the end of the year on business plans by which transmission networks operators will deliver them.

Reform and expansion will dramatically affect connections to the network in the next few years and should see them move much faster. The pause, in comparison, will barely register.

![Mercedes-Benz_eActros_600_(1)[1]](https://d2cohhpa0jt4tw.cloudfront.net/Pictures/274x183/8/1/8/17818_mercedesbenz_eactros_600_11_556244.jpg)