The UK automotive industry is sleepwalking into its next major supply chain crisis, according to Advanced Electric Machines (AEM), which is urging manufacturers and policymakers to act now to eliminate the sector’s reliance on rare earth minerals before it compromises Britain’s electric vehicle transition.

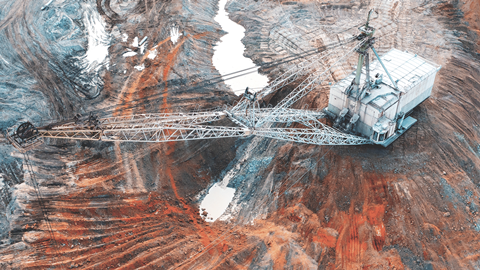

Rare earth minerals are a group of 17 naturally occurring metallic elements essential for high-tech applications, including electronics, renewable energy, and defense systems. China dominates the rest of the world in terms of rare earth mineral reserves, producing around 90% of the global demand.

AEM develops rare earth-free electric motor technology for automotive and industrial applications. The company claims its rare-earth-free motor technology has accumulated more than four million kilometres in real-world operations across commercial vehicles, buses and light rail - delivering comparable performance, lower costs and significantly reduced environmental impact.

In a new white paper released today, AEM warns that the widespread use of rare-earth permanent magnet motors in electric vehicles has created a single point of failure comparable to the semiconductor shortage that crippled global car production during the COVID-19 pandemic. Unlike semiconductors, however, this vulnerability is structural, worsening and already being exploited, the paper warns.

Recent export licensing restrictions on rare earth elements from China have forced production shutdowns across Europe, with manufacturers warning that further disruption is imminent.

With one country controlling the vast majority of rare earth processing capacity, the report argues that the UK’s decarbonisation targets, automotive competitiveness and economic security are all now exposed to geopolitical, environmental and cyber risks beyond domestic control.

The white paper also emphasises that most electric vehicles rely on up to a kilogram of rare earths per motor, materials that are environmentally destructive to extract and increasingly subject to export controls.

With the UK’s Zero Emission Vehicle (ZEV) mandate requiring 80% of new car sales to be zero-emission by 2030, and new van sales to be 70% zero-emission by 2030, AEM argues that current supply trajectories simply cannot support the required growth in EV production.

The report challenges the assumption that rare earths are unavoidable. It sets out how proven, commercially deployed alternatives already exist such as AEM’s rare-earth-free motor technology.

Lifecycle analysis cited in the report shows magnet-free motors can cut environmental impact by more than half compared to conventional permanent magnet designs, while also removing exposure to volatile rare earth pricing and geopolitically concentrated supply chains.

AEM welcomed the UK government’s new Critical Minerals Strategy as a positive step in recognising the risks of highly concentrated supply chains, but the manufacturer argues resilience will not be achieved by simply sourcing rare earths from different places.

Where proven technologies exist that eliminate the need for critical minerals altogether, accelerating their adoption offers a faster, more secure route to meeting net zero targets and protecting the UK automotive sector from future disruption, the paper advises.

Dr James Widmer, Advanced Electric Machines chief executive and founder, said: “We’ve been here before. The semiconductor crisis showed how quickly a hidden dependency can shut down production, damage confidence, and cost the industry billions.

“Rare earths represent an even greater risk because the dependency is deeper, the supply chains are more concentrated, and the disruption is no longer hypothetical. The technology to remove this vulnerability already exists. What’s missing is the urgency to adopt it.”

The white paper calls for immediate pilot programmes by UK manufacturers, coordinated supply chain risk assessments, and targeted government support to accelerate domestic production of rare-earth-free motors.

It argues that establishing even partial independence within the next five years would materially reduce the risk of production shutdowns, missed climate targets and loss of consumer confidence in the EV transition.

![Mercedes-Benz_eActros_600_(1)[1]](https://d2cohhpa0jt4tw.cloudfront.net/Pictures/274x183/8/1/8/17818_mercedesbenz_eactros_600_11_556244.jpg)