Battery-powered heavy trucks are ‘gaining traction’, according to a new survey from consultancy CapGemini.

In a survey of over 750 executives worldwide, the company found that advances in battery technology, charging infrastructure and government policies are changing the perception that heavy-duty vehicles are poor candidates for battery electrification due to the size, weight and cost of the batteries required.

In a report on the research (The Battery Revolution) it cited the German government’s Power to the Road project, launched in 2024, to build a nationwide fast-charging network for heavy-duty vehicles. This initiative aims to build 350 fast-charging sites, covering 95% of Germany’s highways, to encourage the adoption of electric trucks, which currently make up just over 2% of the commercial truck fleet.

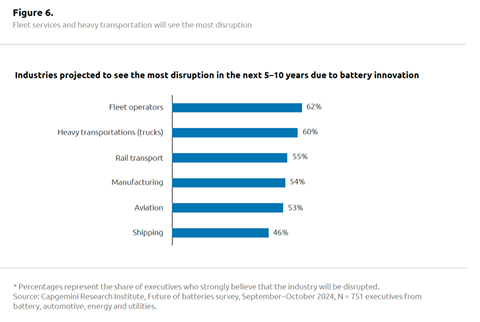

Three in five of the battery, automotive and energy and utilities executives surveyed by CapGemini said battery innovation will “significantly impact fleet operators and heavy transportation”.

Although lithium-based batteries are currently most common CapGemini found that higher energy densities, faster charging times and improved safety meant solid state batteries could be “a game-changer”. It said “Almost every EV producer including Toyota, VW, BMW and Ford are investing heavily in this technology, with commercialisation expected by the end of this decade”.

However, CapGemini found that current battery production lines are not compatible with manufacturing solid state batteries. It said, “The shift to advanced chemistries demands significant modifications or entirely new production lines to meet evolving manufacturing requirements”.

CapGemini also asked about using batteries as grid assets in its survey. It quoted Mark Cavill of E.ON, who said that “Batteries must generate revenue not only through traditional charge/discharge cycles but also by leveraging additional revenue streams. For instance, frequency response services pay for availability, which preserves battery life since these micro-cycles involve minor charge/discharge actions. Batteries may also receive capacity payments for being on standby for emergencies. Essentially, battery operators must treat the asset as a mini power plant, balancing cycles, lifespan, and revenue options to ensure long-term investment viability.”

![Mercedes-Benz_eActros_600_(1)[1]](https://d2cohhpa0jt4tw.cloudfront.net/Pictures/274x183/8/1/8/17818_mercedesbenz_eactros_600_11_556244.jpg)