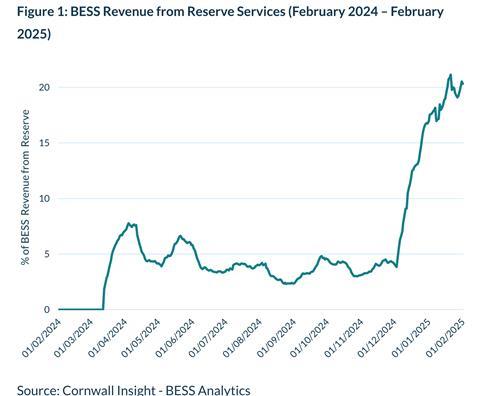

A market for batteries to respond to fluctuations in the electricity grid and start charging or discharging within a minute has represented 20% of battery owners’ revenues since December 2024, according to energy industry analysts and consultations Cornwall Insight.

As renewables increase, electricity supply becomes more variable and in response the National Energy System Operator (NESO) introduced Quick Reserve in November 2024. This helps manage frequency to counter supply-demand imbalances by getting battery owners to ramp up charging or discharge rapidly – i.e. within one minute. Other options can only offer negative services or react too slowly for this purpose, so batteries are taking up the challenge.

For companies that own and operate standalone batteries, these so-called grid stabilising reserve services represented just 4% of revenues at the start of December, as NESO introduced the new opportunity. Now Cornwall Insight data show average battery revenues have quadrupled over the past year. Half of this increase has occurred since December 2024, with the rise largely attributed to the new service. Batteries also benefitted from tight system margins, which drive up prices.

Cornwall Insight’s BESS Analytics Energy Storage Revenue Index saw the 30-day rolling average increase from £21,000/MW/yr in January 2024 to £92,000/MW/yr in January 2025

Cornwall Insight said there “has been a relatively narrow range of technologies bidding into Quick Reserve so far, with batteries very much dominating, and accounting for all accepted volumes during December 2024”.

The company noted that another 6000MW of batteries are due to come online by the end of 2025. That could mean “market saturation dampening revenues”, it said.

Dr Matthew Chadwick, Lead Research Analyst at Cornwall Insight, said: “The rapid rise of battery storage revenues from Quick Reserve highlights how critical flexibility services are becoming in the UK’s evolving energy system. Ultimately, getting to net zero will involve more intermittent energy generation coming on to the grid, and that is where batteries will thrive. Other technologies simply do not have the ability to ramp up production that quickly – Quick Reserve is a batteries market.

“Of course, as with any revenue stream, the more competition there is, the less the returns. With another 6GW of batteries due to come onto the system this year – and more to follow – we could see revenues for Quick Reserve fall, as returns on other frequency response services have done.”