Motor Transport asks some of the industry’s leading players to assess the current market and give their verdicts on how 2025 will play out for themselves and their competitors…

Bob Terris, chairman, Meachers Global Logistics

Any optimism that existed a year ago has been completely destroyed by the actions the government has taken in the short period they have been in power.

Obviously, people will have less money to spend and this will flow through to a drop in demand for the services our industry provides. This, in addition to increased employment costs and other operating costs is likely to have a detrimental effect on profit numbers as it will be difficult to pass these costs on if demand reduces.

If you consider the trading results produced in recent months, and the number of company failures, it is clear that the situation has worsened considerably since we last aired our views. However, I am a little more optimistic about our own situation for the forthcoming year. We have recently renewed some substantial long-term contracts and are in discussions regarding some other opportunities which should have a beneficial effect on our performance in the coming year. Dealing with the ongoing situation will be a challenge but I am confident that we will deal with it as always.

Des Evans, transport consultant and author

This time last year I wrote the following thoughts regarding prospects for the industry in 2024…

“I fear for the industry this year with low rates, high costs, delayed payments, intense competition and poorly policed cabotage incidents.

“On top of that there is the uncertainty regarding future vehicle acquisition, uncompetitive pricing for EVs, unreliable charging infrastructure, uncertainty regarding the future residual value of EVs and expensive insurance. Other than that it’s business as usual!”

It appears that my wishful thinking has an element of truth around it. By the end of December 2024 over 500 UK transport operators had gone out of business. Reasons for their failures are many but include poor cash flow due to late payments or in some cases no payment.

Add to that increased costs for drivers, insurance, tyres and general services together with increased competition resulting in lower rates. And the perfect storm for the industry will be delivered with the future increase in Employers National Insurance.

This cost will hit not only hauliers but all the suppliers to the industry such as vehicle dealers, bodybuilders, trailer manufacturers, rental and finance companies.

This tax will have a significant impact on future profitability as the industry continues on its path of uncertainty due to the chaotic and confusing net-zero regulatory environment.

Every SME involved in the industry that employs more than the tax exemption threshold will find that their cost of employment will be in the order of at least £1,300 per employee.

This will reduce investment, employment and future pay awards - the opposite of what this government are hoping to achieve.

One company I know well, which employs 172 staff at three sites will see its costs increase by over £200,000 and reduce its overall profitability by 10%. This will certainly mean a freeze on both headcount and investment in a market that is looking very uncertain.

But their business has recovered from a loss-making operation to a profitable business by making some hard decisions on investment in the franchise and developing other associated service businesses.

I am not sure that this government is aware that the transport and automotive sectors have typical margins of 2-3% and the future employer NIC tax is a major cost increase.

The UK election was one hurdle for the transport industry to negotiate, only to find itself after five months with a new Transport Secretary. This must be a new low and the industry must now wonder if their voices will be heard when discussing the net zero plans which right now are damaging the futures of vehicle manufacturers and operators alike.

The closure of the Stellantis plan at Luton could be the first domino to fall in 2025. The net zero targets for van suppliers next year may well see the supply of new ICE vehicles reduced in order to achieve the EV targets and avoid the £15,000 per unit penalty. This will see the price of new ICE vehicles increase along with increases in used vehicle prices as a result of reduced supply of both.

In order to provide the battery packs for EVs the UK still needs to see the construction of at least 3 Gigawatt battery production sites capable of producing 500,000 units per site per annum.

Unfortunately not one has started yet and is unlikely to appear next year. This will mean further supply of Chinese manufactured EVs as the Chinese. have access to some 70% of all EV battery production worldwide.

With regard to infrastructure development this will continue to lag behind the required levels due to lack of investment. Government tax incentives need to focus on improving depot-based charging sites where VAT is charged at 5% and consideration needs to be given to reducing the 20% VAT charge at public sites .

At some stage the government needs to introduce road charging for all vehicles and this may be a way of controlling congestion flows in both towns and motorways. But first there needs to be a Transport Secretary appointed who will be in office for more that five months and hopefully the life of this Parliament. But the new one is the same as the old one! I know Heidi Alexander as she is a local Swindon MP but Labour think that transport is about buses and trains and forgets that 90% of what gets delivered goes by truck or van.

There are three things she could address:

1. Change the regulation that fines OEMs £15k per unit for not achieving their EV targets. You cannot force demand for consumption of a product that is not wanted.

2. Focus on developing the charging infrastructure and reduce VAT to 5% on all public EV chargers.

3. Introduce a scrappage scheme for 10,000 x 10 year old+ Euro-6 & Euro-5 tractor units.

A grant of £20,000 per unit for the 10,000 units will cost £200m. This will provide the deposit on an equivalent EV unit and potentially start the experience of EV HGV use for many operators.

This action should be in collaboration with the OEMs who could act as dismantlers/ recyclers of the vehicles and provide a supply of recycled parts for the remaining Euro-6 units currently in operation.

Taking 10,000 tractor units out of service will reduce emissions by 1 million tonnes and would be a significant boost to the net zero challenge.

For all those working in the transport, logistics and automotive industries in 2025 I send my best wishes and the very best of luck. Because you are all going to need it.

Moreton Cullimore, MD, Cullimore Group and RHA chairperson

While both 2023 and 2024 were without doubt some of the most challenging years that all sectors within our industry have faced, with a very stagnant economy, I think a lot of us felt that there would be more optimism and opportunity come spring 2025 when economic predictions hinted at growth and rejuvenation; then the new Government’s budget was announced. This undoubtedly hits businesses and ‘family firms’ very hard and it’s hard to see the optimism we might have had for 2025.

Yet again we will be hit from all angles with further unpredicted costs and yet again the industry will have to find new ways to deal with them. I worry though, that it may well be the final straw for a few and we could see more businesses fall away. We have to continue to work better together and support our trade associations and communicate harder then ever before to try and make government hear the very real stories; what other option do we really have? Of course I remain hopeful that the economy, despite the challenges, just knuckles down and gets on with it so we can hopefully push through and create easier times for us where we can all strive to flourish.

Andrew Malcolm MBE, chief executive, Malcolm Group

I could say the same as I did last year as not much has changed. This year is an even bigger challenge than last especially with the implications of the budget and the rise in National Insurance. Customers are still seeing a slower than planned recovery with some suggesting it could be 2026? We remain confident that our own company and employees are in a position to take on new opportunities as they arise.

Charlie Shiels, chief executive, ArrowXL

We entered 2024 with hopes of a better 12 months than 2023, but sadly it wasn’t to be. A new government, continuing wars and strong economic headwinds conspired against our industry, and the wider UK economy. As we enter 2025, sadly I feel a stronger sense of foreboding than I did 12 months ago. 2025 will no doubt be a very challenging year.

We have seen nothing from those in control to support our industry. If anything, they seem to be putting higher hurdles in our way. The Budget in October and the plans to change workers’ rights will not help UK PLC drive growth, profitability or increased investment. Increases to the National Living Wage and NI in April will drive a significant increase into our employment costs, and decisions will have to made about how much of the extra costs can be absorbed, how much can be passed on to our customers, and how much has to come off 2025 pay increases.

However, much of the above is out of our hands and as always, ArrowXL will focus on what we can control. We will continue to invest in our people and our systems, with a focus on innovation and investments in IT security. We’ve invested in an amazing planning system, and we’re currently investigating a new warehouse management system, as-well as evaluating how AI can help us to drive efficiencies.

Adapting to changes in the economy will be key for 2025, but delivering excellent customer service and being a great employer will remain our priority.

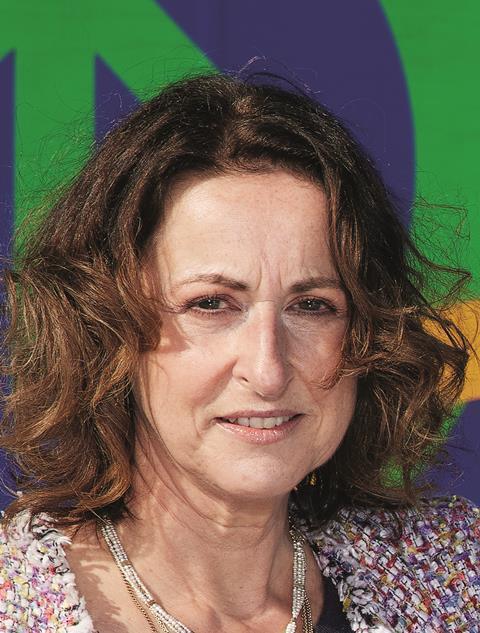

Lesley O’Brien OBE, MD, Freightlink Europe

As we enter a new year, we should be full of hope, looking forward with optimism and enthusiasm to what the year ahead will bring. Sadly 2024 has been a hard year for everyone, not least the transport industry, as we have seen an unprecedented number of our colleagues go to the wall in a relatively short period of time. Many of these have been long-standing, hard working, reputable family businesses - invaluable contributors to our industry.

The challenges of 2024 have simply been a hurdle too far. Regretfully I don’t think that we have yet seen the light at the end of the tunnel. Our industry still faces an acute driver shortage; those entering the industry have little realisation of how hard life on the road can be. A new generation of drivers are looking for work / life balance. Long hours away from home, with few adequate facilities simply are not acceptable and we see a conveyor belt of drivers entering and then leaving the industry.

The imposed increase in National Insurance advised in the Budget will simply be ‘the straw that broke the camel’s back’ for many. Hauliers need to be looking at the impact now and discussing new price structures with clients. However, the necessary tariff increases will have to include not only the increase that hauliers will suffer, but their suppliers will also have NI increases to pass on. It would be naïve to think that salary increases due to the forthcoming increase in minimum wage apply to the lowest paid only. This will force up salaries across the board – and more National Insurance payable.

Of course the transport industry is not the only industry struggling in the current economic climate, a consequence of which is less freight to move around. Hauliers cannot afford to subsidise freight costs as they compete in a shrinking economy, nor lose control of finances. The Freightlink Europe mantra remains customer service, communication and cash are king.

Barry Byers, MD, Pall-Ex UK Group

We are continuing to generate growth from a volume and profitability perspective in both Pall-Ex UK and the Fortec Distribution Network and that positive trend is set to continue during 2025. However, we have had to be innovative, through product diversification and commercial campaigns to achieve those gains in a highly competitive market. Demand from consumers has stagnated which is evidenced clearly in the lack of growth across the sector volumes which is captured and reported through the Association of Pallet Networks.

It is clear to see the excessive number of well-known transport companies going into administration which at present is a consistent occurrence. At a time when costs have escalated for a prolonged period beyond normal inflationary levels the issue remains that too many in our industry compete through offering loss-making prices with far too many operators chasing revenue to generate cash rather than holding firm on the correct pricing that enables transport companies to support sustainable and viable operations. We can see this through the prices our customers are offered. Fortunately, customers do value a high-quality service rather than a short-term price reduction, which has been the key to our growth in volumes and profitability.

In 2025 my prediction would be that we continue to see modest growth levels although the economy will remain sluggish. Through the number of operators ceasing to trade we will see the market volumes and revenues consolidate to be serviced by fewer operators which should result in a healthier position for transport companies to relieve some of those financial pressures in the last 24 months and I sincerely hope we see fewer companies fail in 2025. If this transpires then we will see prices recover across the industry to support the sustainability of our industry which is essential for all.

Our shareholder membership model has really proven to be robust in the last few challenging years and I also predict that the Pall-Ex Group will continue to flourish in the years ahead. I wish everyone well for 2025.