MT asks some of the industry’s leading players to assess the increasingly tough market and give their verdicts on how 2024 will play out for themselves and their competitors…

Andrew Malcolm MBE, chief executive, Malcolm Group

It is going to be a very challenging year for all within the logistics sector and beyond. With over capacity of trucks and customers feeling the pressures on costs too many people are taking a very dangerous short / immediate view of things with no consideration for future / resilience planning.

Peak season didn’t happen last year across most market sectors although we came through it okay as we managed to realign some parts in advance. I’m serously concerned for the SMEs working for low margins. Cash flow could be a major issue as customers try to hold onto their money as long as they can.

These are challenging times. However, there will be opportunities later this year, unfortunately at the expense of others.

Bob Terris, chairman, Meachers Global Logistics

The industry is now feeling the impact of huge cost increases over the past three years. This in itself is not a huge problem when the demand for services exceeds supply and price increases can be implemented. However, we are now in a completely different situation with a drop in volumes and supply now exceeding demand. This has put pressure on margins which many operators are struggling to accommodate, hence the increase in company failures recently.

I feel that company failures are likely to increase further in the short term which may be the saviour of those that can withstand the current situation. The other factor is that the driver shortage is being disguised due to reduction in demand but this will certainly come back to haunt us when the economy eventually improves, which will again result in substantial increases in employment costs.

It is difficult to be very optimistic in the short term but having experienced these situations before I am sure those who can handle this situation will benefit in the longer term.

Charlie Shiels, chief executive, ArrowXL

It’s a game of two halves. The first half is the ‘here and now’ and to be honest, confidence is limited. It’s incredibly tough out there for retailers (our clients) at the moment, as the great British public are being cautious and keeping whatever cash they have in the bank and not spending it after the festive expenses. January and February are always demanding and volumes are hard to find.

But from spring 2024 onwards, and the mid/longer-term, my confidence errs towards positivity. Inflation is reducing, which means interest rates can come down. So get them down NOW please Bank Of England.

Much of what we read shows the UK avoiding a recession (hopefully) and consumers should grow in confidence as the economic indicators turn more positive. That said I don’t know too many people in our sector who don’t think the government are hopeless and whoever else gets elected will be just as bad.

In terms of the peak season, our trading was positive. ArrowXL had record-breaking volumes post Black Friday, but that highest-ever volume was predicated on a small number of retailers doing VERY well. In fact, many of our clients failed to hit the volume forecasts shared with us. But a win is a win and we broke our records.

That said, I fear for the sector. It’s incredibly tough out there and I feel for the numerous companies in logistics that could not hang on. Some historic names have gone in the last 6 months and there are probably more to come.

The margins are wafer thin and, as an industry, we continue to be our own worst enemy. But it’s dog eat dog and our first loyalty is to our own bottom line, our customers and our people. We have our heads held high and continue to deliver the best-ever service levels and win new volume streams to support our growth plans. Apart from that we are continuing to focus on investing in our people and eradicating complexity.

Des Evans, transport consultant and author

I fear for the industry this year with low rates, high costs, delayed payments, intense competition and poorly policed cabotage incidents.

On top of that there is the uncertainty regarding future vehicle acquisition, uncompetitive pricing for EVs, unreliable charging infrastructure, uncertainty regarding the future residual value of EVs and expensive insurance. Other than that it’s business as usual!

Unfortunately the industry is its own worst enemy. Manufacturers are focused on making products that their customers can’t afford. Operators are charging rates that are below cost. Supermarkets are depressing costs and stalling payments. And Royal Mail is a great example of how not to run a transport business.

I wish I could point to an initiative that will allow the industry to recover but I can’t see any innovation in the short term that will change things. What I do detect is a period of mass consolidation amongst the 34,000 UK O-licence holders.

Improved telematics will aid efficiency, fuel and driver performance but it will require a very focused management to execute this change and deliver better revenue and profits.

Barry Byers, MD, Pall-Ex UK Group

Pall-Ex UK and the Fortec Distribution Network are seeing growth in volumes and profits when compared to last year. This is being achieved during a period when the market sector has seen a significant volume decline which is captured and reported through the Association of Pallet Networks.

Fortec is currently the fastest growing express palletised freight network in the UK with Pall-Ex not too far behind. Our policy of providing service performance at a highly competitive cost is winning new business and market share in a very challenging market. Our member shareholder ownership model really supports our stability through the market pressures we are experiencing at present.

The peak volumes for our sector are seen from easter through to early summer so we are preparing for a significant up trade during that period. In the run up to Christmas we saw growth year on year but volumes were slightly suppressed by the wider economic conditions as consumer demand was down across the UK.

The news of a significant increase in transport companies going into administration is a real concern and we manage our networks very carefully during times of economic pressure. The reality is that companies who have overexpanded during the good times are finding it increasingly difficult to reduce cost commitments when volumes and associated revenues decline.

We work closely with members and audit their performance to ensure they are operating efficiently, controlling pricing and margins effectively and ensuring debt collection and cash availability is managed effectively. Furthermore, a key initiative was deployed in late 2022 in which we invested in the deployment of a national sales team to support the commercial success of our 150 Shareholder Members across the UK. This has been a hugely successful initiative that has enabled us to grow our members revenues whilst our competitors are experiencing decline. These actions underpin the stability of our networks ans protects the quality of the service we provide to our valued customers.

Moreton Cullimore, MD, Cullimore Group and RHA chairperson

It all depends which section of the industry you look at. Transport linked to the construction industry has been awful the last year. We’ve seen a 40%+ reduction in sales as mortgage rates have just frozen the housing market solid. But our general haulage has maintained a steady consistent pattern of business.

I do know, though, that peak season didn’t really experience any peak. The amount of administrations is scary, and we are all suffering on huge increased costs and these look likely to continue with the national minimum wage going up again in April. As businesses we will be expected to follow suit with staff on their pay who are even well above the minimum wage thresholds. Customers are not accepting price increases in the most part and those that are, haven’t agreed increases which reflect the cost increases. It’s looking like it will be a tough year. We can only hope that market confidence will grow and spring budgets will inject life into the UK economy quickly.

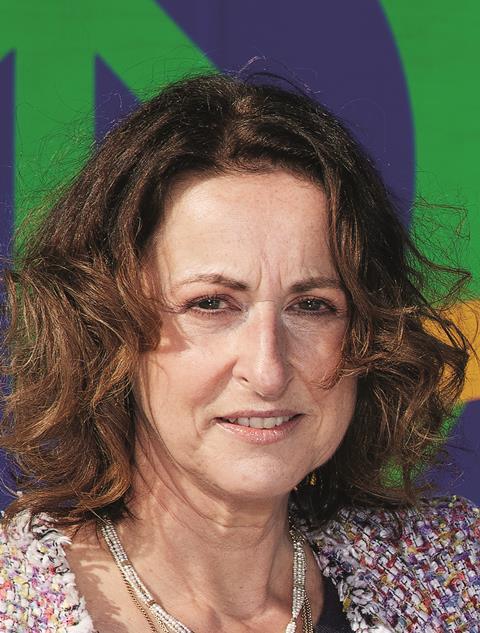

Lesley O’Brien OBE, MD, Freightlink Europe

The transport industry seems to go from one crisis to another. Our industry was seen as the saviour during Covid. We saw drivers’ salaries soar and rates increase to a more acceptable level as customers and the general public recognised the importance of our industry and how much the economy relied upon it. Post Covid, we have seen our costs rise beyond expectations at the same time as there has been a decline in the UK and global economy. Once again the transport industry has suffered, as there is less product moving around the world and customers force down rates as they too fight the shrinking economy.

Tragically we have seen some of the most respected and longstanding businesses ‘go to the wall’. As an industry that survives on the lowest of margins it is basic economics that hauliers cannot withstand the high cost of maintenance, insurance, tyres, finance, investing in the new DVS standard etc and continue to be pushed down on price. Sadly, sometimes hauliers are their own worst enemy as they too compete against each other on price and the larger operators force extended payment terms on their smaller counterparts. As always, cash is king and sadly we may see more casualties in our industry, before we again see an upturn, especially as the months of December and January commercially represent 3-week months.

![APN Founder & Chairman Paul Sanders[1] copy](https://d2cohhpa0jt4tw.cloudfront.net/Pictures/480xAny/0/2/6/17026_apnfounderchairmanpaulsanders1copy_992114.jpg)

Paul Sanders, founder & chair, Association of Pallet Networks

Overall we are cautiously confident about the resilience of the pallet sector in 2024 and the hauliers which maintain it. There’s no doubt that sector volumes are down, and that always requires adjustment from network members. However, the sector delivered 28.4m pallets in 2023, which is still 5% higher than in 2019.

The general consensus in the industry at large is that ‘Christmas didn’t happen’. I think the whole freight industry will have found Q4 volumes disappointing – the early figures from pundits seem to put retail sales volumes at 4% down. We’ll now have to see how much continued conflict in the Gulf and higher interest rates continue to affect freight customers and consumer spending.

While there are certainly challenges in the economy at large, including steep price rises for customers and road transport providers, pallet networks are ideally placed to help companies ride out challenging periods. Their customers can flex between full or part loads, and pay-as-you-go palletised freight consignments depending upon what is most cost-effective for them at the time, or the volumes they need to deliver.

Customers can also flex between economy and premium services, which enables them to minimise their transport costs or to prioritise service as they see fit. That said, next day deliveries still account for more than 60% of pallet volumes, so there isn’t significant evidence that customers are choosing the cheapest option.

How SMEs can best tackle the tough market is a perennial question in haulage, rather than a new one. And the answer is the same in good times or tough times. Hauliers must watch their cash flow. Most operations would be wise to remember that not all business is good business and to review those accounts which pay late, or whose credit score may have changed.

Efficiency is also important. Vehicle data must not be ignored. Telematics monitoring fuel and driver behaviour, for example, where there is overwhelming evidence that it saves fuel. These marginal gains from running the most efficient business rather than simply the ‘busiest’ business can be the difference between profit and loss when the economy is hard.

And of course efficiency is exactly why the networks originated. The pallet network model was designed as the way to make national overnight transport viable for smaller regional companies, and that collaborative consolidated model is still one of their most effective safety nets.