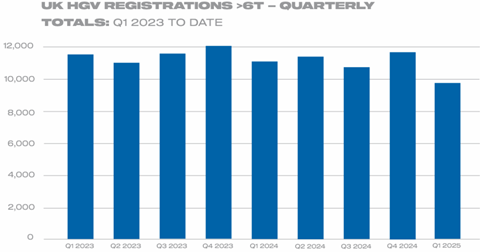

Britain’s new HGV market declined by 12.0% in the first three months of 2025 with 9,738 new trucks joining the road, whilst registrations of new zero emission HGVs almost doubled, up 94.0%, although this amounted to just 97 units.

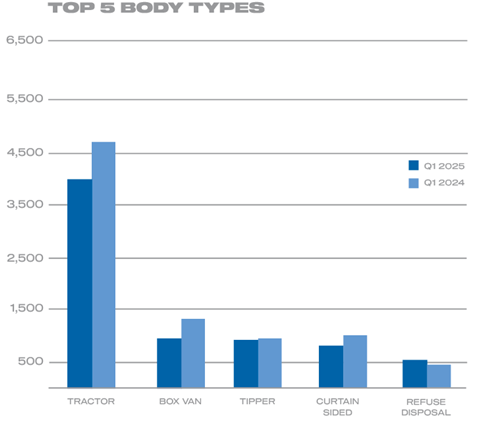

According to the latest figures published this week by the Society of Motor Manufacturers and Traders (SMMT), the bulk of the decline came from a 15.0% fall in registrations of new tractors, at 3,953 units, accounting for 40.6% of the overall market in the quarter.

Demand for new box vans and curtain-siders also fell, by 26.3% and 18.1% to 959 and 767 units respectively, while new tipper registrations dipped by just 4.6%, equivalent to 41 fewer units. Bucking the trend, demand for refuse collection vehicles rose by 20.6% to 520 units.

Registrations of new zero emission HGVs almost doubled, up 94.0%. With an overall market share of 1.0%, up from 0.5% a year ago, this is the highest proportion of zero emission trucks registered in a quarter, which SMMT said demonstrates a small but growing demand for the very latest and greenest models after flatlining last year.

Manufacturers continue to invest heavily in innovation with 35 models currently available as zero emission.

However zero emission HGVs still remain a fraction of the market, SMMT said, warning that this must grow rapidly over the next decade if the UK is to achieve its target for all new HGVs up to 26 tonnes – the majority of the market – to be zero emission by 2035, with the remainder of the sector following by 2040.

The society warned: “The heavy commercial vehicle transition continues to be supported by government’s improved Plug-in Truck Grant and its Zero Emission HGV and Infrastructure Demonstrator (ZEHID) programme but immediate action is needed to remove onerous planning procedures that prevent timely rollout of charging and refuelling infrastructure at depots – meaning operators may have to wait up to 15 years for a grid connection – as well as on the strategic road network.”

SMMT called for action to ensure the transition is accelerated by giving transport depots the same priority for fast-tracked grid connection as that recently announced for data centres, wind farms and solar – along with a national strategy that delivers HGV-suitable infrastructure at public and en-route locations.

Guaranteeing more affordable depot and public charging would further underline the case for operators to switch sooner – delivering cleaner air and quieter streets, and cutting operating costs, SMMT argued.

Mike Hawes, SMMT chief executive, said: “As the UK’s new truck market normalises after a turbulent few years, industry is already setting a new course for green growth with almost three dozen different zero emission models now available, and a record quarterly market share.

“Onerous planning processes, however, are acting as a handbrake on depot and public infrastructure, and fast-tracked grid connections are essential if more HGV fleets are to be decarbonised.”