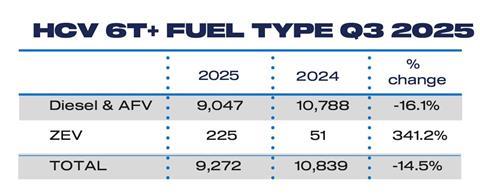

New heavy goods vehicle (HGV) registrations declined by 14.5% in the third quarter of 2025 with 9,272 new trucks entering service in the UK, whilst, conversely, demand for zero emission HGVs quadrupled, according to the latest data published by the Society of Motor Manufacturers and Traders (SMMT).

Announcing the findings, SMMT said the market’s fifth consecutive quarterly fall, with the market down 12.5% in 2025 to date, “comes amid a challenging economic backdrop – but also reflects the natural ebb and flow of fleet renewal cycles following three years of sustained post-pandemic growth”.

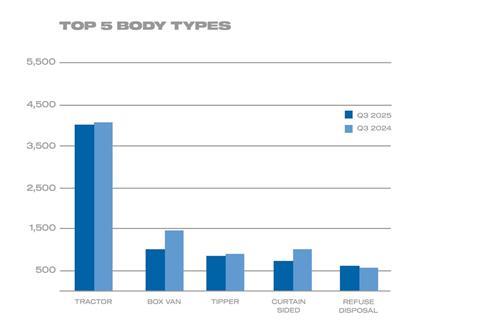

The contraction included reduced demand for tractor units, down by 2.2% to 3,966 units – but still representing two-fifths (42.8%) of the market – while the box van segment saw the largest volume decline, down 38.7% to 899 units.

The conventionally lower volume tipper and curtain-sided segments also fell, by 10.1% and 38.1% to 712 and 606 units respectively.

There was growth, however, with demand for new refuse disposal trucks up 9.5% to 578 units – albeit representing the market’s smallest segment in the top five.

In contrast to the decline in diesel truck demand, new zero emission HGV uptake continued to rise, quadrupling by 341.2% to 225 units in Q3, a new record volume, and also achieving record 2.4% market share.

The significant quarterly demand has driven year-to-date ZEV volumes to 408 units, up 145.8% compared with the same period in 2024.

SMMT hailed this as a significant achievement, making Britain Europe’s second largest zero emission HGV market by volume.

It added that this demand could grow even faster with the right support, pointing to limited access to ZEV charging and refuelling infrastructure, which it said was a major challenge for depot-based operators, with waiting times for grid connection as much as 15 years.

SMMT added: “Industry welcomed the government’s Depot Charging Scheme announced in July to help more operators fund the switch but timely infrastructure delivery requires prioritisation of HGV depots for grid connection rollout – benefitting from the fast-tracking processes already afforded data centres, wind farms and solar projects.

“With a clear route toward ZEV and infrastructure investment, operators who already face tight margins will be more confident to decarbonise their fleet which is fundamental to the country’s Net Zero ambitions.”

Mike Hawes, SMMT Chief Executive, said: “New HGV uptake continues to normalise amid a tough economic backdrop so while another quarter of decline is unsurprising, returning to growth is important to keep businesses moving via the very latest, greenest models.

“Industry continues to invest significantly in zero emission rollout, and rising operator uptake is positive – but more substantial volume growth depends on infrastructure rollout.

“Fast-tracking depot grid connections, in particular, is critical to help operators plan and invest – and for manufacturers to continue delivering the green growth Britain needs.”