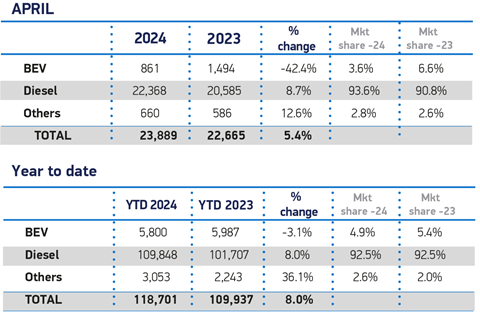

As UK demand for new light commercial vehicles (LCVs) rose by 5.4% in April, uptake of electric vans plunged by almost half, accounting for just 3.6% of all new van registrations, compared with 6.6% in the same period last year.

According to new figures published today by the Society of Motor Manufacturers and Traders (SMMT), 23,889 new vans, 4x4s and pickups were registered, the highest total for the month since 2021.

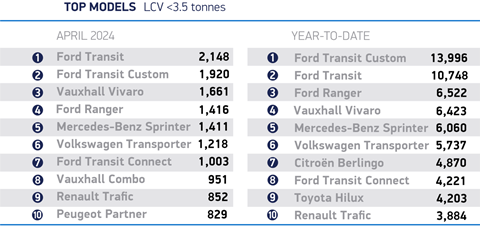

Growth across the market was underpinned by the long-term popularity of the largest LCV models weighing more than 2.5 tonnes to 3.5 tonnes, which rose 3.3% to 15,714 units – accounting for almost two thirds (65.8%) of registrations.

Deliveries of medium-sized vans grew by 6.8% to 4,611 units, while the biggest percentage increase was for the smallest vans, up 41.1% – albeit still representing just 2.5% of the market.

Pick-up volumes also rose, by 16.2% to 2,487 units, while deliveries of new 4x4s fell by -17.6% to 473 units, compared with a particularly strong April last year.

However deliveries of the very latest zero emission LCVs declined last month, with new battery electric van (BEV) uptake falling to 861 units, down by 42.4% compared with last year’s uptick in demand.

BEVs accounted for just 3.6% of all new LCV registrations compared with 6.6% in April last year. SMMT said the month traditionally has low registration volumes following new plate March and is therefore subject to volatility, however, it warned that such a decline in BEV uptake – just as government targets demand rapid growth – puts green goals at risk.

The industry’s latest market outlook expects the UK’s new van market to grow by 3.3% to 353,000 units this year, while BEV market share has been revised to 8.3%, down from 9.4% in the January outlook.

BEV volumes are still expected to rise by 44.1% in 2024 to 29,000 units, but uptake is set to remain below the ambitious sales targets set for manufacturers in the Vehicle Emissions Trading Scheme (VETS).

Meanwhile Ford LCVs continue to dominate, with the Ford transit and Ford Transit Custom coming in first and second place respectively in April as the top sellers.

Announcing its findings, SMMT said: ”Manufacturers continue to invest to deliver more zero emission models with competitive ranges and payloads, quiet operation and high comfort levels – but they alone cannot drive Britain’s green goals. While some flexibilities in the early years of the VETS will help, the lack of suitable public charging infrastructure for vans remains a significant barrier to switching to zero emission fleet operations.”

It called for a nationally planned, locally delivered chargepoint strategy that meets the specific needs of vans – particularly the largest models for which existing infrastructure is not normally suitable.

”Identifying the best places to locate such chargepoints, while speeding up grid connections in every part of the country, is essential to give operators confidence to invest. Given the current need to create the right conditions for more fleets to switch, the Plug-in Van Grant must also remain in place, or the UK risks slowing down road decarbonisation.”

Mike Hawes, SMMT chief executive, added: ”Britain’s new van market continues to grow with the very latest, more fuel efficient models driving down CO2 – a core mission for the sector.

”Manufacturers are investing billions to bring electric vehicles to market, however, uptake is slowing and urgent action is needed.

”If government is serious about delivery of its ambitious targets, it must deploy an equally bold strategy for delivering van-suitable public chargepoints across the UK, now the single most important step to get a greener Britain moving.”