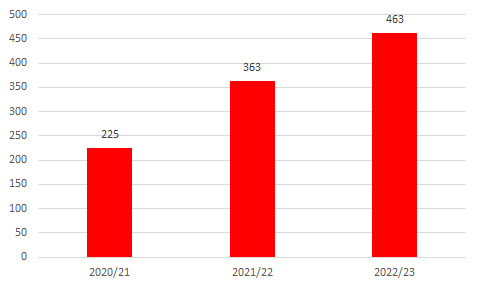

A record 463 British haulage businesses have collapsed in the last 12 months, more than double the number two years ago, according to data obtained by Price Bailey, the Top 30 accountants.

The data, obtained by Price Bailey under the Freedom of Information Act, shows that the number of haulage businesses entering insolvency jumped from 225 in 2020/21, to 363 in 2021/22 and then to 463 in the most recent 12-month period, representing a rise of 173% in just two years (year ending 30 September).

Price Bailey also looked at the credit risk score of the UK haulage sector. It revealed that 33% of businesses in the sector are deemed maximum risk, up from 22% 12 months ago. Businesses in the maximum risk category are considered at imminent risk of collapse and will find it almost impossible to access extra funding unless directors provide personal guarantees.

According to Price Bailey, a convergence of adverse factors is squeezing the haulage sector, including soaring overheads, driven by fuel and wage rises, coupled with interest rate hikes which have made servicing debt increasingly expensive.

Price Bailey says that recent policy decisions have also hit the haulage sector hard. The Bank of England interest rate began the year at 3.5% but has been hiked aggressively over the past six months finishing at 5% by the end of Q2. Many haulage businesses rely on debt to finance their fleets, premises, and even day-to-day operational costs, which has meant that debt payments have risen with each rate hike.

Matt Howard, head of the insolvency and recovery team at Price Bailey, said: “Business failures among hauliers are rising at a rate unheard of in more than a decade. We are seeing a perfect storm of high inflation and interest rates at a time when many haulage businesses are on life support.”

He added: “Haulage is a low margin business. Aggressive interest rate hikes this year have really turned the screw. Many hauliers rely on debt finance to fund everything from fleet acquisition to day-to-day running costs, making them vulnerable to rising interest rates. Rising overheads as a proportion of turnover are pushing many haulage businesses into the red. Business failures are likely to continue to rise throughout the second half of the year.

Haulage businesses to have gone bust in recent months include Mark Stewart in Humberside. In its latest accounts, made up to the end of October 2022, Mark Stewart posted a loss of £200,000. At the time it employed 25 people. A month before Stewart’s demise KNP went into administration. The group employed more than 750 employees and had a 350-truck, 500-trailer fleet and 55,000 square metres of distribution space. In June Tuffnells was forced to call in the administrators. The company has since been acquiredin part by logistics tech platform, Shift. In the same month Cross Transport in Birmingham also failed. The business had a fleet of 200 vehicles operating across the UK

According to the RAC the price of diesel has jumped by 11% since 17 July 2023, from 144.36 pence per litre to 160.44 pence per litre on 9 November 2023. Price Bailey said that that while most hauliers pass on the cost of fuel to customers, in the form of a fuel surcharge, the amount is usually reviewed monthly, meaning that sharp rises in fuel prices in a matter of weeks cannot be recovered until the following month.

Howard said: “Diesel costs fell from their peak in the summer of 2022 but they have started to rise sharply again over the last few months. Geopolitical tensions in the Middle East could accelerate that trend, which would pile more costs on embattled UK hauliers. In many cases the fuel price rises we have seen over the last few months will have completely wiped out any profits hauliers would have made on margins of just a few per cent.”

Price Bailey also points out that the cost of new and second-hand cabs and trailers has rocketed over the past year or so with a corresponding increase in insurance costs. For example, units costing £85,000 plus VAT with three months delivery last year are now costing £115,000 with at least eight months delivery.