Warehouse occupiers, led by retailers and 3PLs, are pushing ahead with plans to upgrade their networks, despite the current political and economic uncertainty.

Property experts say that, while operators may have contingency plans in place for Brexit, they are focusing more on the long-term efficiency of their supply chains.

Knight Frank’s head of national logistics & industrial Charles Binks comments: “Many companies have reached a point where they can’t continue keeping their plans in abeyance. They have got to crack on.”

Despite more caution among manufacturers and foreign-owned businesses, others are continuing to take space. This has not been down to the need to stockpile which, he says, has largely been catered for by spare space within retailers’ and manufacturers’ warehouse networks and those of their 3PLs.

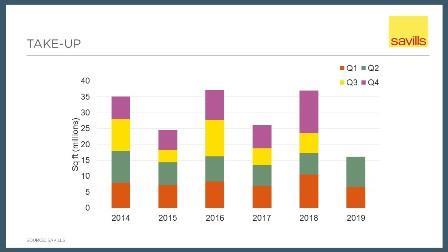

According to Savills’ Big Box Briefing report, take-up of buildings over 100,000 sq ft reached 16.1 million sq ft in H1, 28% higher than the long-term average. The figure for Q2 of 9.6 million sq ft was the highest Q2 take-up since 2014.

Richard Sullivan, national head of industrial & logistics at Savills, says that while Brexit preparations including stockpiling have hit the headlines, most companies are motivated by other factors.

“We believe that Brexit has had little impact thus far on occupier demand and activity and there are instead far more important factors driving the market, such as structural change in the retail sector,” he comments.

Emile Naus, a partner of management consultancy BearingPoint, says that there is some stockpiling going on but that the opportunities are becoming limited because of the time of year.

“It is much harder to do now than it was in March because October and November are the peak months for storage anyway,” he says.

According to Savills’ research there are signs of increased activity among high street retailers, whose share of overall take-up has grown from 7% to 11%, in contrast to e-commerce which has fallen from 27% to 17%. The 3PL sector was responsible for 31% of take-up – a higher proportion than any other sector.