MT’s latest UK Commercial Vehicle Operator Report, produced in association with Texaco Lubricants, reveals the value of being smart.

There’s much talk of the squeezed middle in British politics but the latest UK Commercial Vehicle Operator Report confirms the emergence of savvy operators forming a smart middle within road transport.

These operators are pulling forward their purchasing to beat Euro-6, providing services to external clients via their in-house workshops, and making use of the latest technology to optimise the running of their businesses.

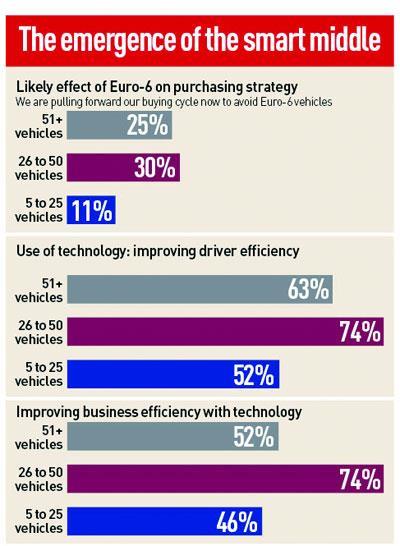

The trend, identified in 2011’s report and confirmed by our latest findings, demonstrates that the smart middle, those operating fleets of 26 to 50 vehicles are sweating their assets and optimising their operations to a far greater degree than either smaller operations or the larger players (those running 51 vehicles or more).

With 2013 set to be another tough year – forecasts for UK growth are around the 1% mark – being swift of foot and making the most of what you’ve got is likely to be the difference between a profitable 12 months and calling in the administrators.

In-house is best, isn’t it?

According to our 500-strong sample the smart middle are most likely to carry out maintenance in their own workshops, with 35% using them exclusively and 44% using them in combination with service alternatives.

A very high proportion service third-party vehicles at their facilities, no doubt in part to recoup costs because, unlike the largest players in the sector, they lack the scale to mitigate them. Larger fleets have a clear preference for franchised dealers while small fleets have a mix-and-match approach to maintenance.

Respondents list breakdowns – other than completing the job at hand – as their single biggest concern and only 5% of our sample had not had at least one breakdown in the past year. The average breakdown rate for our entire sample is 22.31 during 12 months.

However, where things get really interesting is when this is analysed by maintenance approach. While those that have their trucks maintained at a dealer see, on average, 15.07 breakdowns a year, it is in-house workshops that have by far and away the poorest track record. Vehicles maintained at in-house workshops average 31.94 breakdowns a year.

The single biggest causes of breakdowns across all fleet sizes are electrical faults (72%) and tyre failures (60%). In combination, engine or exhaust failure, including cooling systems, was identified by 76% of operators as the culprit.

Purchasing power

Our sample vehicle parc represents some 52,000 vehicles and reveals that Daf showed its competitors a clean pair of heels last year, making inroads into the larger fleets and growing its market share to 38%. Mercedes-Benz slid to 16%, while Volvo improved to take a 17% share of all vehicles in our sample. Scania slipped from a 16% to 7% share.

Nearly half of all vehicles are still bought new (44%), not least because in terms of total ownership costs and in an era of strong residual values, it remains the cheapest way to buy a truck. Amongst fleets of 26 to 50 vehicles half of all trucks are bought new.

Overall, the concept of buying and owning still dominates the marketplace but it has declined from a 69% stranglehold in 2010 and 51% in 2011 to its current level.

Among small and medium fleets the importance of second-hand trucks has grown accordingly, from 3% of their fleets in 2010 to 12% in 2012.

Contract hire has followed a similar pattern and is no longer simply an option for own-account operators. It reached 18% last year, having been at the 12% mark in 2010. Operating leases have declined in popularity, from a high of 30% in 2011 to 26% in 2012, but remain popular.

Regardless of how they are acquired, 40% of vehicles are now sold with a repair and maintenance contract.

On average, our respondents bought 11.4 new trucks, two second-hand, took 3.6 on rental or contract hire, and extended rental or hire agreements on 2.2 last year, substantially lower than 2011’s activity.

Year ahead

For 2013, our sample expect to purchase an average of 12.8 vehicles, 1.8 second-hand trucks, 2.9 via rental or contract hire, and extend just 0.7 rental or contract hire agreements.

This last point appears to show that extending rental or contract hire contracts, a popular contingency during the recession, is waning. This is in part due to the banks that finance these lease deals wanting the ageing vehicles off their books and calling them back at the end of their extended terms.

The second factor is that the very largest fleets are some of the biggest users of rental and contract hire and, as revealed in the full report, they value image and reliability more highly than anything else. With our research revealing that older vehicles are more likely to be serviced in-house, which has the highest incidence of breakdowns, the large fleets are opting to replace run-on vehicles.

So while there will be activity, especially among the largest players, the balance of feedback from our sample ultimately suggests greater fleet consolidation within the road transport industry during 2013.

Euro what?

The Euro-6 engine emissions deadline comes into force in just a year, yet our research suggests road transport remains surprisingly unaware, with 52% having no awareness of the specific January 2014 implementation date. While 28% of the market claim to have given Euro-6 no consideration in terms of their purchasing strategies, this is weighted towards the small fleets with the typical MT reader much better informed. Among medium and large fleets more than two-thirds and almost three- quarters, respectively, supplied a response in regards to whether they think the advent of Euro-6 will affect their purchasing plans. As a consequence, 25% of very large fleets and 30% of medium fleets plan to bring truck purchases forward this year (buying almost entirely Euro-5 units) ahead of the emissions deadline.

Road transport in numbers

- Total number of commercial vehicles in the UK: 465,000 (2010: 470,000), although 357,982 of these are within the O-licence system.

- There are 84,640 commercial vehicle operator licences currently in issue (2011: 87,747), with hire and reward operators still comprising more than half (52%).

- There are 132,600 registered vehicles over 31 tonnes in weight, more than a quarter of the UK’s vehicle park.

- Between them Daf and Mercedes-Benz account for 43.3% of new truck registrations over 6 tonnes.

- There are an estimated 227,000 trailers in use in the UK.

- Average LGV age has climbed since 2008 to hit 7.4 years.

- 28% of the UK vehicle parc is operated by less than 1% of O-licence holders.

Knowledge is power

This article only scratches the surface of MT’s Commercial Vehicle Operator Report, which has been produced in association with Texaco Lubricants.

The report is the most comprehensive information source available on today’s road transport industry, and essential for any operator planning its strategy for 2013.

Available for £595, the 80-plus-page document also includes in-depth interviews with a representative sample of 500 road transport operators. This year-on-year comparative analysis also reveals what competitors’ purchasing strategies and intentions are this year (including who is buying what).

Other subjects comprehensively covered include what factors influence purchasing decisions (and why fuel isn’t the number one priority), the composition of UK fleets, profitability, fuel purchasing, and breakdown rates by configuration and vehicle type (where relevant with data presented by fleet size).

In short, with a wealth of insight you won’t find anywhere else, it’s something you can’t afford not to have at your fingertips in 2013.

For the full story download MT’s UK Commercial Vehicle Operator Report now or call 020 8912 2170.